April 1, 2024

There are many assets which astute individuals will obtain in order to enjoy a source of long-term financial stability. Common examples include stocks, commodities, real estate, and even fine wines. However, art and high-end collectibles represent yet another massive sector and they can often be used to hedge against the volatility often associated with open-market fluctuations. What are a handful of professional tips and tricks that can be used to focus your efforts in the right direction? Let us examine some practical real-world advice.

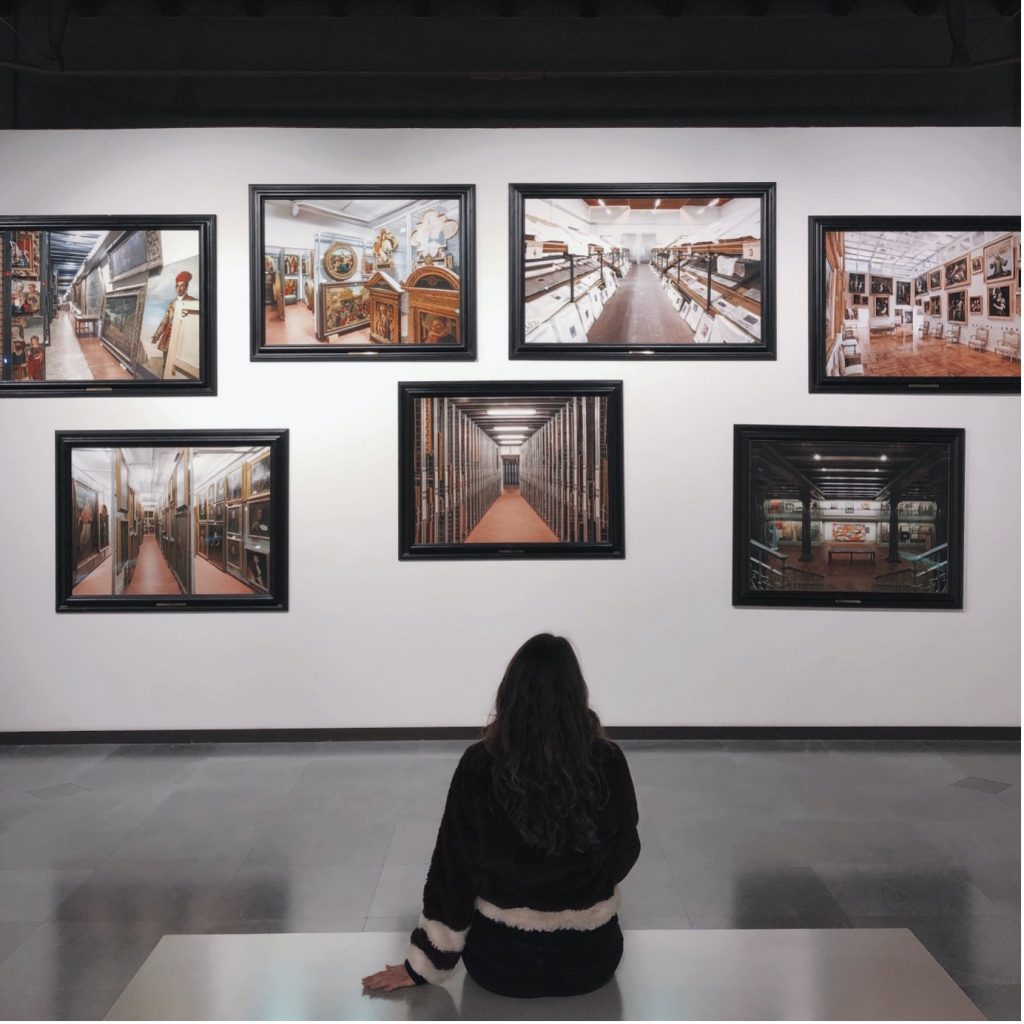

Become Familiar with the Industry

One of the most common mistakes involves individuals who become involved with multiple simultaneous investments. While this might appear to be “adding another string to the bow” in regards to the art and collectibles markets, the fact of the matter is that it can be difficult to keep track of longitudinal price movements, It is therefore much better to become specialised in a specific field (such as antique watches or Baroque art) in order to understand what affects the value of the items themselves.

Photo by Klaudia Piaskowska on Unsplash

Primary Versus Secondary Markets

When purchasing art and some types of collectibles, you will generally encounter two options:

- Primary markets

- Secondary markets

Those who obtain a work of art directly through the artist or creator will be dealing with the primary market. Secondary markets instead involve third-party sources such as dealers, auction houses or estate sales. Most experts consider secondary markets to pose less of a financial risk, as values tend to be more established. It is also easier to predict a future return on investment (ROI).

Photo by Mick Haupt on Unsplash

Consider Art Investment Funds

Those who are considering an investment within this domain should also examine the possibility of becoming involved with a managed fund. Art investment funds are similar to equity funds due to the fact that they are overseen by an account specialist. These funds also boast a significant amount of diversity; providing a means to tap into a balanced portfolio. Furthermore, it is normally possible to become involved with an art investment fund at lower pricing points. This once again helps to mitigate the risks that might otherwise be associated with 100 per cent ownership.

Practical Concerns

Expensive artifacts, rare art and valuable collectibles must be cared for properly at all times. Even the slightest amount of incorrect care or storage can lead to devastating consequences in terms of value. This is the main reason why knowledgeable investors will always employ firms such as www.corapartners.com that provide professional household teams specialising in the proper storage and care techniques. Furthermore, this strategy can also be used to lower insurance premiums; an ancillary benefit that should never be overlooked.

Investing in art and rare collectibles is an excellent way to help ensure a steady rate of return while avoiding unpredictable market conditions. In terms of long-term financial security, these are some of the most popular strategies to employ.